Home buying valuations and surveys – do you know the difference?

As part of the home buying process it is likely that you will need to have the property you want to buy valued and/or surveyed before you can proceed with the transaction. In this guide we look at the difference between a valuation and a survey, and explain the various types of home survey available.

Mortgage Valuation

A mortgage valuation is carried out to satisfy your mortgage lender that the property you wish to buy is adequate security for the sum you are asking to borrow. This is because the lender needs to be reassured that their investment is safe before approving your mortgage. However, it is important to understand that although a mortgage valuation may enable a buyer to receive a mortgage, it is prepared purely for the benefit of the bank or building society. As such, a mortgage valuation has limitations, including the following:

-

it may not identify structural problems

-

it may not identify significant defects such as dampness or dry rot

-

it may not identify all necessary repairs

-

it may sometimes be carried out remotely in a matter of minutes using only online valuation tools

-

it creates no contractual relationship between the buyer and the firm providing the valuation, and as such shouldn't be relied upon by the buyer

-

it is limited in scope and is likely to provide only brief information

-

the information is intended for the purposes of the lender only

The mortgage valuation is arranged by the lender and the fee will typically be charged alongside other items as part of the total mortgage costs. Some lenders include the valuation fee for free as part of the mortgage deal.

The cost of a mortgage valuation typically ranges from £150 to £1,500, with more expensive properties attracting a higher fee.

In the event that the mortgage valuation values the property at less than is required for the mortgage you need, you can either dispute the valuation by providing sales evidence of similar properties in the area, reduce the amount you wish to borrow or return to the vendor with a revised offer based on the lender’s valuation.

Surveys

In contrast to a mortgage valuation, a home survey is prepared for the benefit of the buyer. It is intended to serve as a health check on the condition of the property and to identify significant problems that might affect its value or suitability to the buyer.

There are two main professional bodies who provide survey reports:

-

Royal Institution of Chartered Surveyors (RICS)

-

Residential Property Surveyors Association (RPSA)

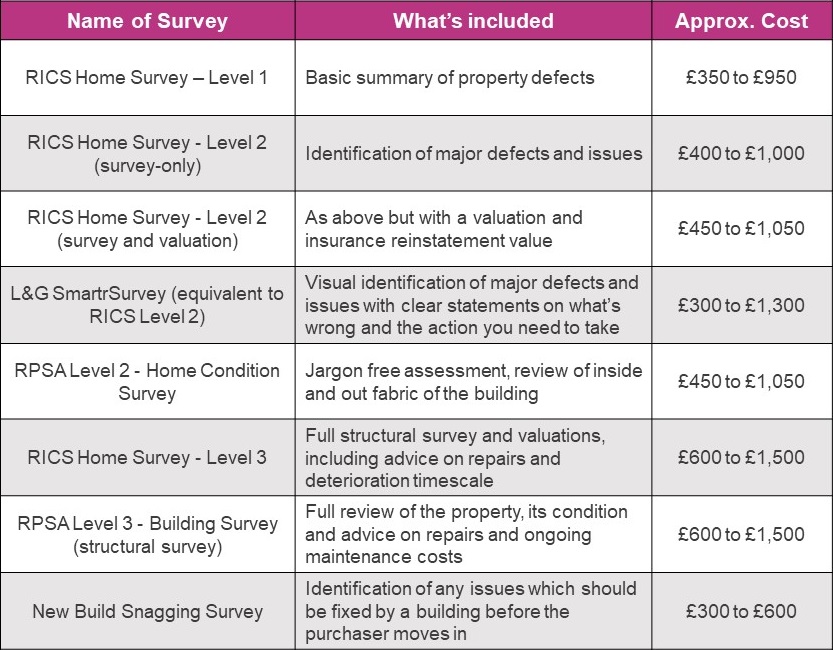

Not all home surveys are the same; some are more detailed than others and will take longer and cost more to complete. Generally surveys are denoted by their level of scrutiny: Level 1, Level 2 or Level 3.

The type of survey you choose will depend on your budget and your needs – for example, whether you are buying a newbuild property or an older, more unusual property. Below we take a look at the major types of survey, from the most basic to the most comprehensive.

Please note, all types of home survey are paid for by the buyer.

RICS Home Survey – Level 1

As the most basic type of home survey this does not contain advice or a valuation. It is one of the least expensive surveys, and is available from around £350 for properties under £100,000 with the cost rising in relation to the property price and complexity. Information provided is limited to the following:

-

basic “traffic light” summaries of the property’s condition. Green equals “ok”; orange equals “cause for concern”; red equals “essential repairs needed”

-

a basic summary of the property’s defects.

RICS Home Survey – Level 2

According to RICS, this is the most popular option for home buyers in Britain. The RICS Home Survey – Level 2 was formerly known as the HomeBuyer Report. It is suitable for most properties of standard size and construction. It uses an easily understood Condition Rating system for the various building elements and, unlike the Level 1 option, it provides advice on dealing with defects and other issues.

There are two types of RICS Home Survey - Level 2

RICS Home Survey - Level 2 (survey-only): This survey should identify any major defects and issues – for example, subsidence, damp or rot – and begins at around £400.

RICS Home Survey - Level 2 (survey and valuation): This survey includes a valuation and an insurance reinstatement value. As such it is slightly more expensive, starting at around £450.

L&G SmartrSurvey (equivalent to RICS Level 2)

The Legal & General SmartrSurvey was created as a digital, photo-based alternative to the traditional HomeBuyer survey and is designed to offer a quicker survey experience for the customer. It is benchmarked as a Home Survey Level 2. Your SmartrSurvey can be viewed on a mobile, tablet or desktop device and the results of the survey are ranked in order of severity with clear photographs and helpful, jargon free, statements. You can share the results of your SmartrSurvey directly with tradespeople and your conveyancer to ensure you are fully informed of any potential costs. This may help you to renegotiate the purchase price of a property.

Your surveyor will call to talk you through your SmartrSurvey before and after the inspection, ensuring you completely understand what will happen and answer any questions you may have with the report.

L&G SmartrSurvey prices from around £300 to £1,300.

RPSA Level 2 - Home Condition Survey

The RPSA Home Condition Survey typically costs around £450 to £1,050 depending on the property value, and is an independently checked report which is published in a “consumer-friendly format”. It includes a check for dampness, a review of the inside and outside condition of the fabric of the building, comment about boundary issues and broadband speed, and it includes helpful pictures and diagrams.

RICS Home Survey - Level 3

The RICS Home Survey Level 3 was formerly known as a Building Survey or Structural Survey. It is suitable for all properties, including those which are too large, old or complicated for a Level 2 report. Starting at around £600, a Home Survey Level 3 is the most comprehensive and detailed survey of the three RICS options. It provides detailed advice on the condition of the property, and will explain how and when to deal with any repairs which are required. A valuation is not provided as standard but may be available on request.

RPSA Level 3 - Building Survey (Structural survey)

Suitable for all types of houses (not flats), but typically used for purchases of older buildings, unusual properties or where a particular defect is suspected. The building survey will provide a thorough review of the property and its condition, including clear advice about repairs and ongoing maintenance required. The RPSA Building Survey will vary in price and starts at around £600.

New Build Snagging Survey

A new build snagging survey is carried out independently of the builder/developer to identify issues which will need to be fixed before the purchaser moves in. The survey should identify minor problems, such as doors and windows which need adjusting, and major defects such as structural issues.

A new build snagging survey will cost around £300 to £600.

What to do if the survey identifies a problem

It is important that you discuss the full implications of the report with the surveyor once it is completed. If a survey identifies problems, this gives you the chance to reconsider your interest in the property and, if you still feel the property is still suitable for you, to adjust your offer in light of any likely repair costs.

With Legal & General SmartrSurvey Services, you can send specific issues from the report direct to tradespeople who will provide quotes for any work that needs doing.

Remember, all offers for properties in England and Wales are made Subject To Contract (STC). This means that you have no legal obligation to proceed until the exchange of contracts.

Disclaimer: The above is for information purposes only and does not constitute a recommendation of any particular service provider or product. All survey prices are approximate and will vary depending on the value and complexity of the property in question.

Send me details

of the Mortgage valuations and surveys

If you do not receive the email with the information attached in a few minutes, please check your "junk mail" or "spam" folder.

We promise not to give your email to anyone else or use it for any other purpose than delivering the requested information.